And the Rich .. will get Richer

It was a chill November evening in downtown San Francisco and I was taking a stroll at Pier 39. The Pier was crowded with just a few weeks to go before Christmas and the sun had began to set. I soon stumbled upon a crowd hovering around a painter who seemed to be bent over his canvas intently. This chap had quite a few paintings laid out neatly on the pavement, and they did look quite unique.

Initially, it didn’t seem quite clear to me as to what he was doing, since he had no paint brush but wore some sort of a protective mask (this was in the pre-covid epoch). Furthermore his canvas was encased from the public in a glass box, accessible only to his hands.

As I watched, he pulled out one of the bottles from the crate, and sprayed a dash of yellow onto his canvas, then red .. in random fashion!! “This was spray painting all right”, but what on earth was he doing, I thought to myself. Pretty soon he was spraying the rest of the canvas with shades of blue and black. A paper weight lying here, a few strokes around it, a pinch there, a nudge with his knuckle and before you knew it — “voila”, before my very own eyes, a picture of a classic moonlight night on a lake emerged.

It didn’t stop there!! He pulled out a sharp blade from somewhere and then began to scratch the canvas, and in doing so, carving out a series of high-rise buildings. Then finally, for the finishing touch, he makes big pointless strikes across the page in straight curvy lines .. and just when I am thinking “what the ??.. and why is he ruining it !!.. “ suddenly! the masterpiece unfolds, the canvas reveals the Golden Gate Bridge in the moonlight lying there before us .. and all this within 7 minutes.

I was quite dumbfounded. I could hear similar sigh’s from the crowd gathered there, many of whom were tourists like myself too. One elderly lady from behind me in the crowd, whispered to one of her friends “now that is Talent!!”.

I tugged on to my waistcoat and looked around even as a chill breeze blew, there were Chinese and a few Indians too, just like me who stood shoulder to shoulder looking over. In economic terms, one could say that — “The Wealth of Nations” had brought us thus far, to foreign lands, given us a fair playing field to compete in and with that the ability to hold our heads high, admire but yet in a very subtle way remain aloof from those whom we consider lesser mortals than ourselves. We would never have to eke it out in the street under the hot summer sun or chilly winters just to get a sale.

As I glanced into the faces of this crowd, the expensive leather and mink coats that some of them donned arrogantly stood out. Their white collar associates in Wall Street had on more than one occasion in the past brought the world economy to its knees due to sheer avarice. They .. wait a sec .. “we” can smile and boast of technical prowess in our own sophisticated domains. These are traits which we proudly flaunt while sitting in air-conditioned cubicles away from the harsh realities of life, believing that number crunching of a certain kind is the basis for a better life, while talent of another kind goes completely unnoticed !!

Weeks later I was browsing through Barnes and Noble (years before it shut down) in one of the most popular sections which I would have gladly rechristened “over-rated self-help”. I picked up a book which I would frequently refer to in years to come. It had a Japanese Author who was a self-made millionaire. His name was Robert Kiyosaki, the book was called ‘Rich Dad Poor Dad’.

As I read the book, the first thing that hit me real hard about this book was how the author defined an “asset”. This seemed to be in complete contrast to what is taught in accounting that classifies an Asset as something that appears on the left side of a balance sheet, or, as something you own. Examples of assets (as we are taught in formal education) normally include your house, your car, your second car, your holiday home, and for some of us maybe even a yacht.

According to the author, an asset is something that puts money into your pocket!! I frowned. Hey, a car surely doesn’t do that. In fact a car guzzles more money than it does fuel, with routine overhaul checks, the occasional upholstery change, road tax, the insurance and the other accessories. In fact the same could be said for all the other so called assets that we call assets which are nothing more than comfort toys of the 21st century that eventually loose their sheen and are eventually replaced.

The classification of an asset here was refreshing. However, the question is, which kind of asset really puts money in your pocket? This is how the plot unfolds. In an interesting elaboration of this concept in another one of his books called The Cash Flow Quadrant, the author slices the different ways you can earn your living into 4 quadrants .

The first category are the employees (also known as the salaried class), this is the largest group in the tax bracket which mostly make up the middle class. Then you have the self-employed category which consists of free-lancers and sometimes even sole-proprietors who quit their previous day jobs to set up their own little outfit so they could print business cards that read “C.E.O” or “founder”. The third and celebrated category are the business owners. These are the people who swallow all the risk and then spend sleepless years worrying about things they have little or no control over. The final category, the investors/shareholders are the smartest. Why? Well simply because they know how to manage money effectively as they know where to invest their money in for the smartest returns (or so, we are told).

The author reserves nothing but contempt for the first category. Salaried employees are their own prisoners in a world where they would never own any ‘assets’. Why so? For they would build their lifestyles around getting into debt around home loans, car loans and sometimes even loans taken at the spur of the moment to aimlessly wander around Paris while taking selfies with their buddies against the Eiffel Tower.

This is the debt-trap that most individuals may take their entire lifetime to pay even as their family sizes increase and expenses skyrocket.

The way to escape the debt trap, the author writes, is to become an entrepreneur!! Yes, you heard correct!! It’s quite simple, by building your own business from scratch you eventually create a cash flow stream that could pay your bills and buy you those expensive luxuries while still paying your utility bills. A revolution indeed!! Provided of course your business succeeds.

The whole idea is to be able to to earn your living in such a way that your ‘assets’ will eventually grow from the epicenter of your initial capital investment that runs your business to the eventual tsunami that would flood your bank account with suitcases of banknotes. While the strategy may have certainly paid off for some of the millionaires, the question is — at what cost and more importantly — how many millions were fallen by the wayside?

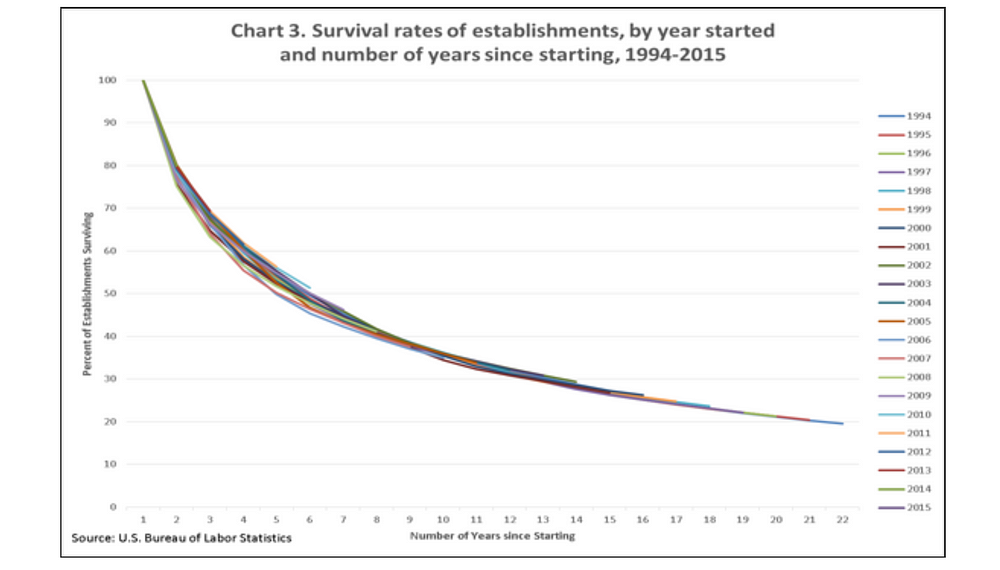

Over the last 20 years its pretty clear that the survival rate for new businesses is falling faster than they used to. Of course, over time, as evident from the above study, more individuals than before have bought into the entrepreneurship bug and believe that fortune favors the brave. These days it seems that entrepreneurship is the shiniest new visiting card. All one needs is to do few online courses on the subject, watch a few online video’s from self-made millionaires and then engage in fancy talk at an uptown cafe while lugging an iMac around, showing snazzy excel charts to all and sundry.

So if the capitalists get to hoard all the money, then what happens to category -2, the freelancers, the lawyers, the painters, the musicians. Should we assume that they too need to learn the subtleties of financial management, corporate accounting or wait — how about we teach them how to write Collateralized Debt Obligations(CDO)!! Now where did I heard this term before?

Well, managing personal finances aside, this lot would never be able to break past the glass ceiling since their specialty was never about the art of the deal in the first place but in passionately pursuing their passion!!

Entrepreneurship needs a very different mindset, one that not everyone has. The problem with capitalism is that it rewards risk-takers with lofty premiums masqueraded as stock/dividends but punishes the other categories with a below average life-style. In fact, it condemns the rest to a life less ordinary, to be left behind and this is what precisely gave rise to the Occupy Wall Street protests some years ago.

The sun is setting now, and even as darkness sets in, the artist counts his pennies, packs his wares into his rusty convertible. backs up into a half empty street and drives off into the night.

2 blocks away, the line outside a night club has now become loud and restless, while inside a bunch of suits sit at the bar sipping on their martini’s.

and the Rich .. will get richer.